ev charger tax credit 2022

Co-authored by Stan Rose. Congress recently passed a retroactive federal tax credit for those who purchased environmentally responsible transportation including costs for EV charging infrastructure.

Tax Tips For Going Green In 2022 Electric Vehicle Charging Business Advisor Go Green

The tax credit covers 30 of a companys costs.

. Along with preserving some of the areas nuclear power plants for clean energy generation the bill also offers rebates on used and new EVs with no MSRP. A rather significant federal tax benefit is available to most taxpayers who recently installed electric vehicle charging stations and it seemingly is a feature that flew under the radar for many. The new tax credit starts with a base amount of 4000 as it is today with another 3500 available if the vehicles battery pack includes at least 40 kwh of capacity for cars placed in service before 2027.

5 Mayer Brown Electric Vehicle and Charging Station Tax Credits. The current form of the federal tax credit is up to 7500 for the purchase of a new hybrid or electric vehicle from a manufacturer that has yet to sell 200000 electrified vehicles. Information specific to your state can be found on the US.

However this credit has a deadline of december 31 2021 and may decrease in 2022 so its recommended that companies looking to install ev charging systems do so before that deadline. The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles. As it stands the credit provides up to 7500 in a tax credit when you claim an ev purchase on taxes filed for the year you acquired the vehicle.

Department of Energys Federal and. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to. The federal tax credit was extended through December 31 2021.

The credit amount will vary based on the capacity of the battery. The 1000 tax credit for charging property installed at a taxpayers residence would not increase but would also. Assessing Proposed Changes June 15 2021 Biden Administration FY 2022 Budget GREEN Act Clean Energy for America Act five years through December 31 2026.

You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25. Federal government also has credits and perks for you to take advantage of. The renewal of an EV tax credit for Tesla provides new opportunities for growth.

Review the credits below to see what you may be able to deduct from the tax you owe. This number varies depending on the capacity of the battery and the vehicles total weight so be. The credit ranges between 2500 and 7500 depending on the capacity of the battery.

The tax credit is retroactive and you can apply for installations made from as far back as 2017. Furthermore Future Energy expects federal tax incentives to be quite robust in 2022. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

So if you recently installed a home EV charging station or completed a large-scale EV infrastructure project you might still be eligible for this. EV Charging Equipment Federal Tax Credit up to 1000. Refer to Virginia Code 581-2250 for specifics.

Since installation costs are significant for EV chargers this rule allows you to get the most tax credit for your. SUBJECT Electric Vehicle Charging Station Tax Credit SUMMARY This bill under the Personal Income Tax Law PITL and the Corporation Tax Law CTL would allow a credit equal to 40 percent of the costs paid or incurred by the owners or. For residential installations the IRS caps the tax credit at 1000.

This credit includes both the 7500 main credit plus another 500 for Tesla cars with American-made batteries House version or another 2500 Senate. 4 of the next 4000 of income. It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs.

For example new EV purchasers may qualify for up to 750 in state tax credits in California in 2022 under the California Clean Fuel Reward program. Anyone with an electric vehicle will be able to use the charging station. The tax credit now expires on December 31 2021.

Similar tax breaks have expired and been extended in recent years and in its current form it applies to property placed. The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. Illinois is set to finally offer residents an EV rebate following a sweeping new bill subsidizing nuclear power plants and offering a wide range of clean energy goals according to the Chicago Tribune via Reddit.

The federal government offers a tax credit for EV charger hardware and EV charger installation costs. This tax credit will stay at 30 through 2019. The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles.

The federal government offers a tax credit for EV charger hardware and EV charger installation costs. 4500 EV Tax Credit. By Andrew Smith February 11 2022.

One benefit for you to reap is an income tax credit of up to 75002. January 13 2022 - To get the federal EV tax credit you have to buy a new and eligible electric car. Unlike some other tax credits this program covers both EV charger hardware AND installation costs.

Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022. You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25. Sunday April 17 2022 Edit.

Heres how you would qualify for the maximum credit. Most Tesla cars sold starting on January 1 2022 would be eligible for an 8000 or 10000 credit. As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations.

Currently the federal government offers a tax credit for both EV charger hardware and for installation costs. Current EV tax credits top out at 7500. Another 500 is added for a US-made.

Another 4500 is available if an automaker makes the EV in the US with a union workforce. You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25. Companies can receive up to 30000 in federal tax credit for commercial installations.

Congress recently passed a retroactive now includes 2018 2019 2020 and through 2021 federal tax cred. Virginia isnt the only entity that aims to incentivize the ownership of electric models. RTC-1v10 Jan 2020 Page 1 of 4.

As in you may qualify for up to 7500 in federal tax credit for your electric vehicle. Residential installation can receive a credit of up to 1000. If so we have great news for you.

Jan 13 2022.

Tax Credit For Electric Vehicle Chargers Enel X

What S In The White House Plan To Expand Electric Car Charging Network Npr

How To Choose The Right Ev Charger For You Forbes Wheels

Ev Charging What You Need To Know About Charging Your Electric Vehicle

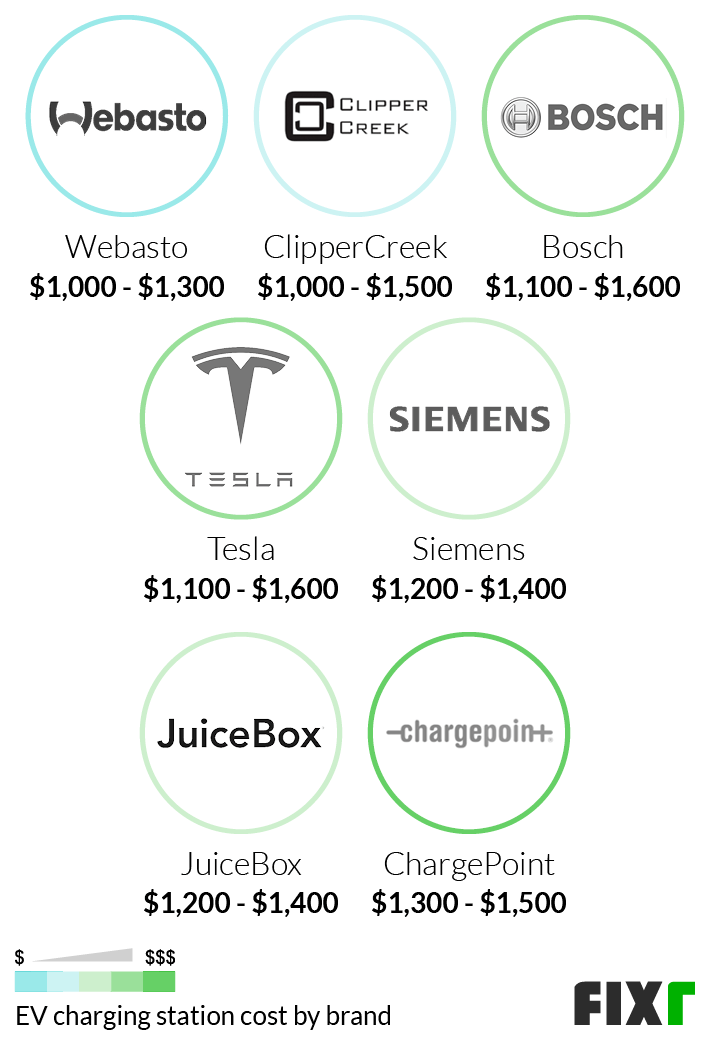

2022 Cost To Install Ev Charger At Home Electric Car Charging Station Cost

How To Claim An Electric Vehicle Tax Credit Enel X

Rebates And Tax Credits For Electric Vehicle Charging Stations

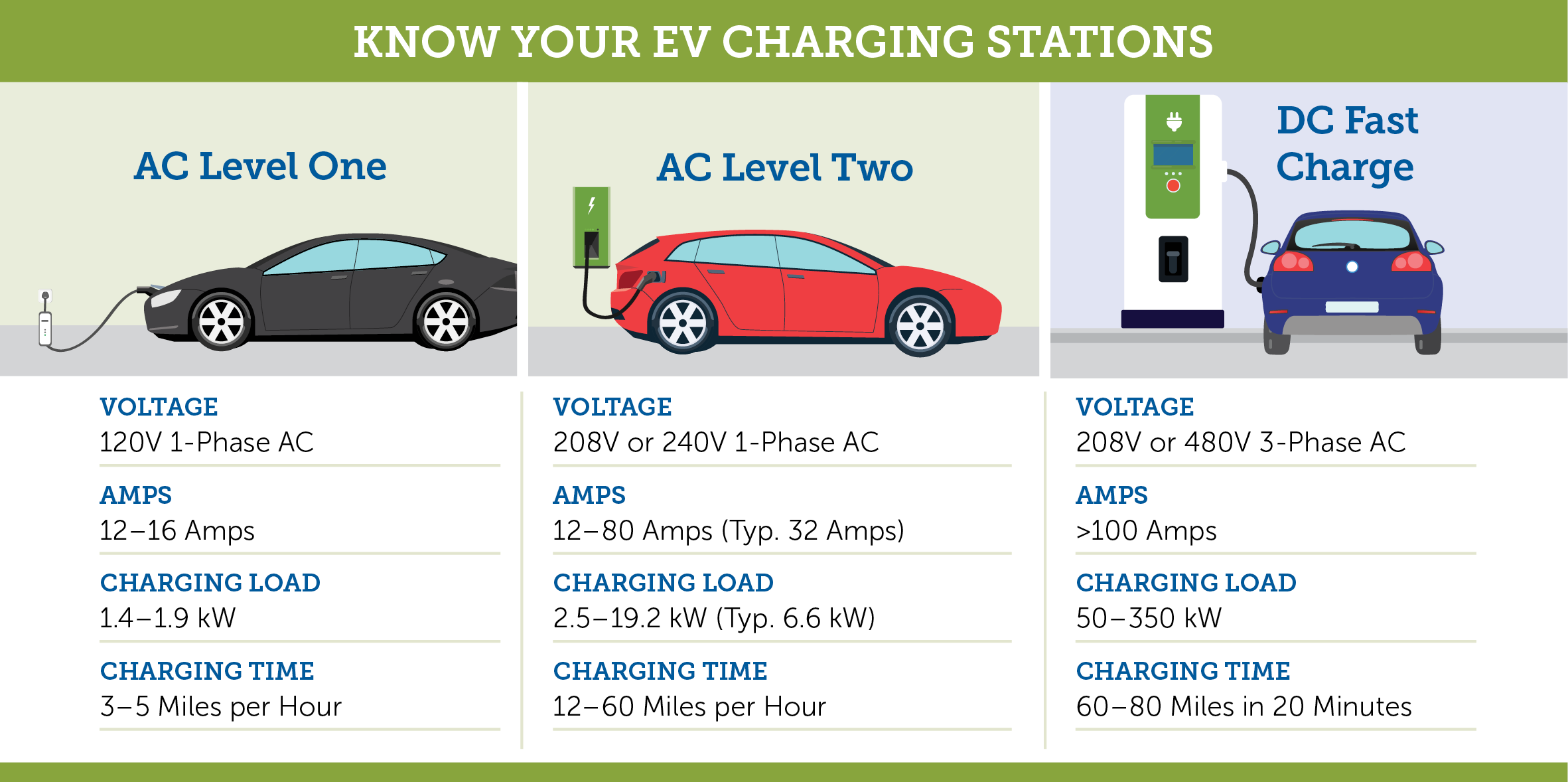

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels

Rebates And Tax Credits For Electric Vehicle Charging Stations Electric Cars Electric Car Charging Electric Vehicle Charging

Need A Home Ev Charging Station Check Out Your Local Autozone

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

About Electric Vehicle Charging Efficiency Maine

Not Nearly Enough Money For Ev Charging In The Infrastructure Bill

Axfast 32amp Level 2 Electric Vehicle Charger Costco

Joe Biden Releases New Ev Charging Plan Protocol

New Profit Center Electric Vehicle Charging Stations

Find Charging Options For Your Electric Vehicle Carolina Country

Home Ev Charger Rebate Guide Chargepoint

/cdn.vox-cdn.com/uploads/chorus_image/image/69405179/1232464562.0.jpg)

The Fastest Way To Get More People To Buy Electric Vehicles Build More Charging Stations Vox